2024 Connecticut Housing Market Report

With the first two quarters of 2024 at an end, we can better see how the Connecticut housing market is going for 2024 so far. This time of year typically sees a rise in inventory as homeowners prepare their properties for sale for the busier seasons.

At present, the demand for houses in Connecticut is higher than the available inventory. The housing stock is currently at an all-time low. According to the Federal Housing Finance Agency's latest House Price Index Report, the United States saw an approximate 7% increase in house prices, with every state increasing. Connecticut had the 7th highest appreciation in price, with an average of a 10% increase in house prices year-on-year. This trend of high house prices and low inventory is predicted to continue.

With mortgage rates stagnant at around 7% and a low inventory of houses for the last six quarters, house price appreciation will also continue to grow. High interest rates have contributed to the lack of inventory, as homeowners are too scared to sell their homes and buy a new house - not knowing if they will be paying more money, even if they locate a smaller property. While mortgage rates have improved slightly, they are still extremely high. Despite the pandemic being in the past, there are still many factors that are contributing to a volatile and uncertain housing market today.

Connecticut is highly sought after, with Hartford, New Haven, and Milford the most popular towns. Stamford and Greenwich are amongst the fastest-growing cities. These, in particular, are a hot spot for New Yorkers due to their proximity to the southwestern coastline.

Connecticut’s housing market is recovering slowly, but fairing well. With everything the housing market has had thrown at it in recent years, Connecticut remains affordable.

Current Market Overview in Connecticut in 2024 So Far

The current median price of a property in Connecticut is $477,600.

House prices grew in June 2024, with an 11.2% increase reported since June 2023. They will continue to grow throughout the year.

The number of properties sold in June 2023 was 4,116. This has decreased to 3,413 in June 2024. The average number of properties sold in Connecticut yearly has decreased by 17.1%.

Properties spent an average of 28 days on the market, which is also down year over year.

Current Supply and Demand in the Connecticut Market

When there is a delicate balance of supply and demand in the real estate market, there will be enough homes for every prospective buyer. However, the perfect balance is not always the case. With the COVID-19 pandemic, the state of the economy, and many other factors, a balance is not easy to strike. The supply of houses is often impacted by government policies, local development, labor, and materials, while the demand can be affected by buyer demographics, personal financial situations, and interest rates.

The rule of thumb is that when buyers outweigh the number of houses for sale, property prices will increase. Conversely, when there are more homes for sale than prospective buyers, house prices will decrease.

With this in mind, here is the latest information on the supply and demand in Connecticut.

Supply

The number of properties available for sale decreased in June 2024. 9,933 homes were reportedly for sale in Connecticut, which decreased by 8.2% compared with last year. Newly listed homes also declined by 14% year over year, with only 3,749 on the market.

Source: https://www.redfin.com/state/Connecticut/housing-market

Demand

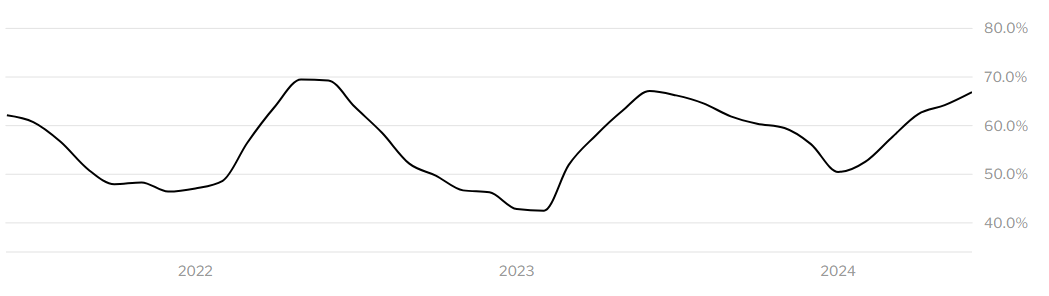

Over half (66.9%) of the listed properties in Connecticut in June 2024 sold above the listing price.

In New Haven, homes sold for a median price of $320,000, an increase of 37.9% year over year. The town of Bridgeport had an even higher growth rate, 41.9% year over year, with a median sale price of $367,250.

Source: https://www.redfin.com/state/Connecticut/housing-market

Top Growing Sales Prices in Connecticut:

Danbury, CT

Newtown, CT

Bristol, CT

New Britain, CT

Middletown, CT

Most Competitive Locations in Connecticut

Newington, CT

Sherwood Manor, CT

Windsor Locks, CT

Southwood Acres, CT

Glastonbury Center, CT

Predictions for the Future of the Connecticut Housing Market – 2024 and Beyond

The Connecticut housing market is on par with the national housing market. It is likely that inventory levels will continue to stay low for the foreseeable future. Sales are likely to remain low, as the lack of homes for sale is driving up house prices. Housing market enthusiasts and experts are optimistic that the Connecticut housing market will grow and get stronger in the future. There is a chance that the sellers who held off during 2023 will want to put their houses on the market in 2024. There has also been a rise in baby boomers looking to downsize. Baby boomers are likely to have equity to buy new houses with cash. This will impact new buyers looking for smaller properties, however, it will add many houses onto the market for sale. New home sales have been increasing in the last few years, so there will likely be more new homes available to sell in the second half of 2024.

Mortgage interest rates should stabilize by the last two quarters of 2024. They are likely to remain high but will come down from the whopping 7.79% they increased to in October 2023. When they decreased in November 2023, there was already a surge in new mortgage applications. This will only increase the further down they go.

The housing market in Connecticut in 2024 is favoring sellers - this has been shown with low average days on the market and the limited number of houses available. You could sell your house fast and for a reasonable price. Connecticut is a great choice for buying a home because of its high quality of life and suburban setting, so if you wish to purchase, you just need to be patient. However, as mortgage interest rates are still very high, you might not land in bidding wars.

It is unlikely that the housing market in Connecticut will crash soon. Connecticut has a dense population, a good local economy, many available jobs, an enticing average cost of living, and much more. Until the demand-supply dynamic changes, the house prices in Connecticut will continue to rise.